値下げ!新品 Orien オリエン 空ボトル 5本

(税込) 送料込み

商品の説明

商品説明

Orienオリエン空ボトル5本新品未使用のお品物です。

検定用に購入しましたが、使用せず余ってしまった為、使っていただける方にお譲りいたします。

ネイル検定で塗りやすいとのことで評判のお品物です。

廃盤となり、手に入りにくいお品物のようです。

プチプチに包んで発送致します。

購入後、箱に入れて保管しており、きれいな状態かと思いますが、自宅保管ですので、神経質な方は購入をお控えください。返品・交換・キャンセルは致しかねます。

ネイル用品6930円値下げ!新品 Orien オリエン 空ボトル 5本コスメ/美容ネイル値下げ!新品 Orien オリエン 空ボトル 5本の通販 by iris_kobe|ラクマ

値下げ!新品 Orien オリエン 空ボトル 5本の通販 by iris_kobe|ラクマ

ネイル値下げ!新品 Orien オリエン 空ボトル 5本 - lovinbox.fr

値下げ!新品 Orien オリエン 空ボトル 5本の通販 by iris_kobe|ラクマ

値下げ!新品 Orien オリエン 空ボトル 5本の通販 by iris_kobe|ラクマ

【2024年最新】オリエン 空ボトルの人気アイテム - メルカリ

オリエン 空ボトル 15ml : 34102 : ネイルワールド - 通販 - Yahoo!ショッピング

ネイルorien オリエン 空ボトル ネイリスト 検定 資格 - www

楽天市場】オリエン 空ボトル | 価格比較 - 商品価格ナビ

人気商品! ホワイトシリカ 1000ml | skinartistry.co.nz

オリエン 空ボトル 15ml

2024年最新】オリエン 空ボトルの人気アイテム - メルカリ

ネイル検定 ポリッシュ オリエンボトル - ネイルカラー・マニキュア

ニッカウヰスキー 余市NV 3本組 - ウイスキー

全ての CND(シーエヌディー)/製品一覧/Shellac(シェラック)/ネイル

DIORDIOR スカーフ - rodrigocastilla.dev

美容液2箱セット✧新品✧インナーシグナル リジュブネイトエキス - 美容液

在庫限り特価品 キラリ麹の炭クレンズ生酵素 × 9 | ubuge.jp

ネイル値下げ!新品 Orien オリエン 空ボトル 5本 - lovinbox.fr

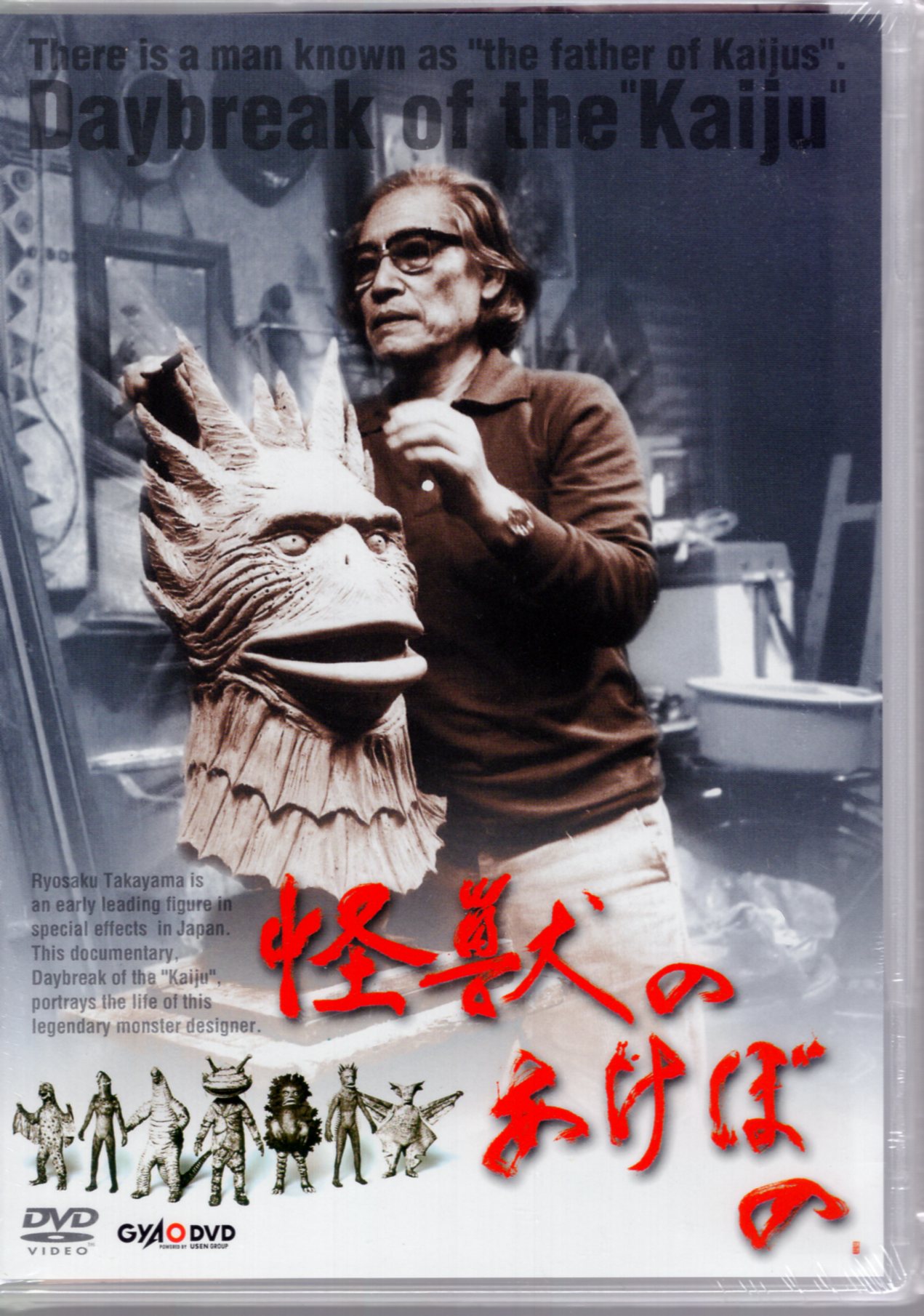

怪獣のあけぼの。幻のレッドキングボックス。特撮 - urtrs.ba

最新発見 ohoraハンドセット【USED品】 ネイルアート用品

最前線の 早い者勝ちです!! 《Y❤︎❤︎様 2個 専用》ネイルチップ

ロングセラー オージュアクエンチ1.8Lセット | solar-laser.com

代引き不可 3dネイルパーツ 3dネイルパーツ ちいかわ 3dネイルパーツ

衆院本会議 期間限定 | landofmedicine.com

2024年最新】オリエン 空ボトルの人気アイテム - メルカリ

エースジェル♡エッジ&トップジェルネイルトップコート/ベースコート

コスメ/美容 ダイエット ダイエット食品

直営店で購入 カールソン様専用!CHANEL プラチナム エゴイスト 100ml

お値下げ商品 DIORフォーエバーリキッドシークイン620 | solar-laser.com

ネイル検定 ポリッシュ オリエンボトル - ネイルカラー・マニキュア

最新発見 ohoraハンドセット【USED品】 ネイルアート用品

怪獣のあけぼの。幻のレッドキングボックス。特撮 - urtrs.ba

ギュープレミアムオイル30ml 1本 【新品未使用品】スキンケア/基礎

ネイル検定 ポリッシュ オリエンボトル - ネイルカラー・マニキュア

DIORDIOR スカーフ - rodrigocastilla.dev

感謝の声続々! ユーキャン ネイル ネイリスト ジェルネイル 検定

GDⅡ美容液☆お値下げ☆ルジュバイタルエッセンスローション GDⅡ

在庫限り特価品 キラリ麹の炭クレンズ生酵素 × 9 | ubuge.jp

ギュープレミアムオイル30ml 1本 【新品未使用品】スキンケア/基礎

専用ページネイル - leslauriers-ci.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています