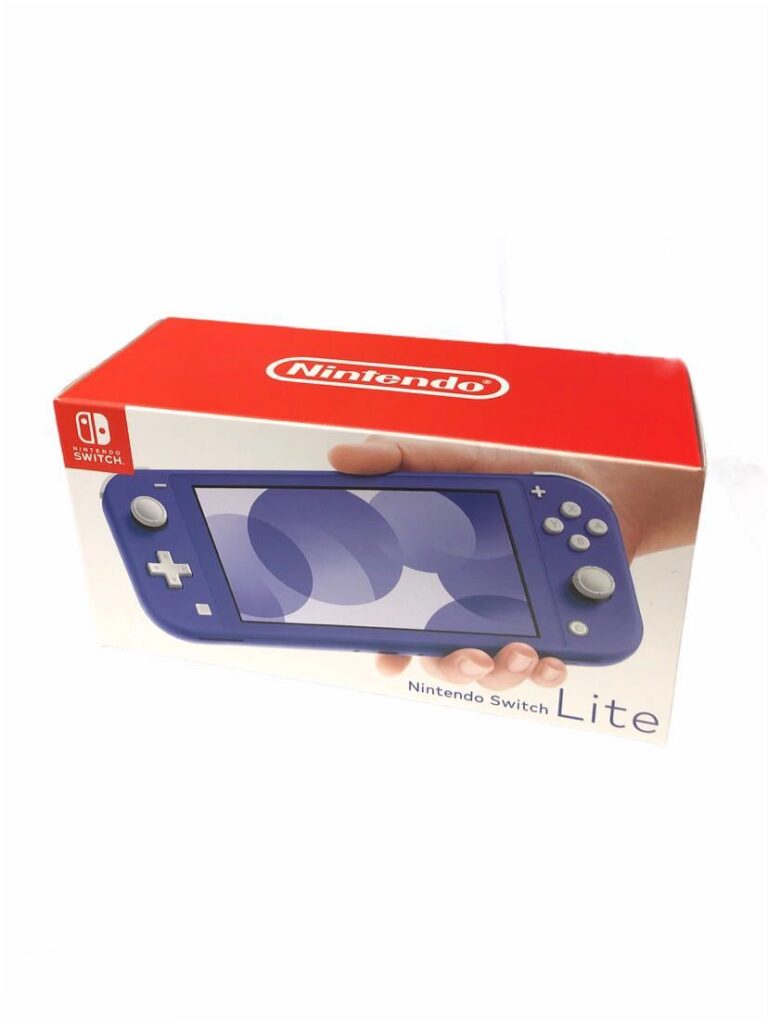

スイッチライト SwitchLite

(税込) 送料込み

商品の説明

商品説明

ご覧頂きありがとうございます。どうぶつの森とスイッチライトコーラルのセット販売です!

発送準備は出来ていますので何時でも発送可能です。

2020年4月に購入いたしました!

(1年間メーカー保証付き)

数回使用しましたがかなり美品です!

他サイトでも出品中のため

突然削除する可能性が御座いますことをご了承下さいませ。

NintendoSwitchNINTENDOSWITCHLITEコーラル

ニンテンドースイッチライト本体

ゲーム機本体種類:NintendoSwitch

ポータブル・据置タイプ:ポータブルタイプ

「NintendoSwitchLiteコーラル」

任天堂

#ニンテンドースイッチ

#任天堂

#Nintendo

#任天堂

#家庭用ゲーム機本体

18000円スイッチライト SwitchLiteエンタメ/ホビー雑誌楽天市場】Switch スイッチ スイッチライト 充電スタンド ニンテンドーNintendo Switch Lite 本体【 充電ケーブル付 】選べるカラー5色 [ターコイズ / ピンク / イエロー / グレー / ブルー ] ニンテンドー スイッチライト : switchlite-5color : ゲームリサイクルDAICHU - 通販 - Yahoo!ショッピング

Nintendo Switch Lite ターコイズ

楽天市場】【レビューでクーポンGET】スイッチライト 本体 Switch Lite

楽天市場】Switch スイッチ スイッチライト 充電スタンド ニンテンドー

ニンテンドースイッチライト ブルーライトカット ガラスフィルム

スイッチライト任天堂スイッチライト Nintendo SwitchLITE 本体 - 携帯

ニンテンドースイッチライト ブルー ターコイズ 2台セット switchlite

Nintendo switchLite スイッチライト - www.sorbillomenu.com

Switchlite任天堂 スイッチライト コーラル Switch Lite Coral - 携帯

Switch Liteの電源が入らない!よくある原因と対処法をご紹介 | Switch

「Nintendo Switch Lite (任天堂 スイッチライト)専用 アシストバッテリー付アクセサリーセット【SL-K】」人気の携帯ゲーム機 「Switch Lite」専用 キャリングケースと便利アイテムがセットになったプレゼントにも最適なスターターセット。ニンテンドー ゲーム

Nintendo Switch Lite - Nintendo Switch - Nintendo - Official Site

Nintendo switchLite スイッチライト - www.sorbillomenu.com

Nintendo Switch Lite - Nintendo Switch - Nintendo - Official Site

楽天市場】Nintendo Switch SwitchLite用 ミニ充電ドック 充電スタンド

失敗例も紹介】Switch/SwitchLiteを自分で修理するのは危険です

Nintendo Switch Lite ケース ソフト シ...|JMEI【ポンパレモール】

ホット販売 ニンテンドー スイッチライト SwitchLite ポケモン | skien

Nintendo Switch Switchlite スイッチ スイッチライト カバー 有機EL

Nintendo Switch/SwitchLite用卓上スタンド 5段階 折りたたみ式 任天堂

代引き手数料無料 スイッチライト SwitchLite 訳あり テレビゲーム

Nintendo SwitchとSwitch Lite、どっちを買うべき? 比較して違いを

ニンテンドー スイッチ / スイッチライト対応 スヌーピー スイッチ

Nintendo Switch Lite (任天堂 スイッチライト)専用 アシストバッテリー付アクセサリーセット ニンテンドー SwitchLite スターター アクセサリー : sl-k : イミディアYahoo!店 - 通販 - Yahoo!ショッピング

ご検討よろしくお願いしますスイッチライトSwitchLite箱ありsdカード

ネクサス株式会社 Switch Lite ケース カバー クリア 透明 抗菌 着脱

内祝い ○Nintendo どうぶつの森セット Switch switchLite 2台

Switch 充電 スタンド 任天堂スイッチ 充電器 スイッチ ライト switch

スイッチライト Switchlite本体 ターコイズブルー フィルム プロテクト

Nintendo SwitchLite(ニンテンドースイッチ ライト) 基板修理 | iPhone

ニンテンドースイッチ本体購入前の確認すること|スイッチライトとの

Nintendo SwitchとSwitch Lite、どっちを買うべき? 比較して違いを

修理】スイッチライトの液晶が割れて映らない場合の対処法 - Nintendo

任天堂 スイッチ ガラスフィルム switch フィルム 2枚 ブルーライト

スイッチ(Switch)やスイッチライト(SwitchLite)のブルースクリーン

ゲオ公式通販サイト/ゲオオンラインストア【新品】Switch

グランドセール Lite スイッチライト SwitchLite ターコイズブルー

任天堂SwitchLite(ニンテンドースイッチライト)ドックコネクタ修理

複数のNintendo Switchでデータ共有! 簡単2つ持ち活用ガイド

139☆訳有り☆Switch lite☆スイッチライト☆操作問題ナシ☆送料込

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています