ひなたライフ 立てかけコンソールテーブル

(税込) 送料込み

商品の説明

商品説明

天板の素材···木定価¥22,440

■サイズ

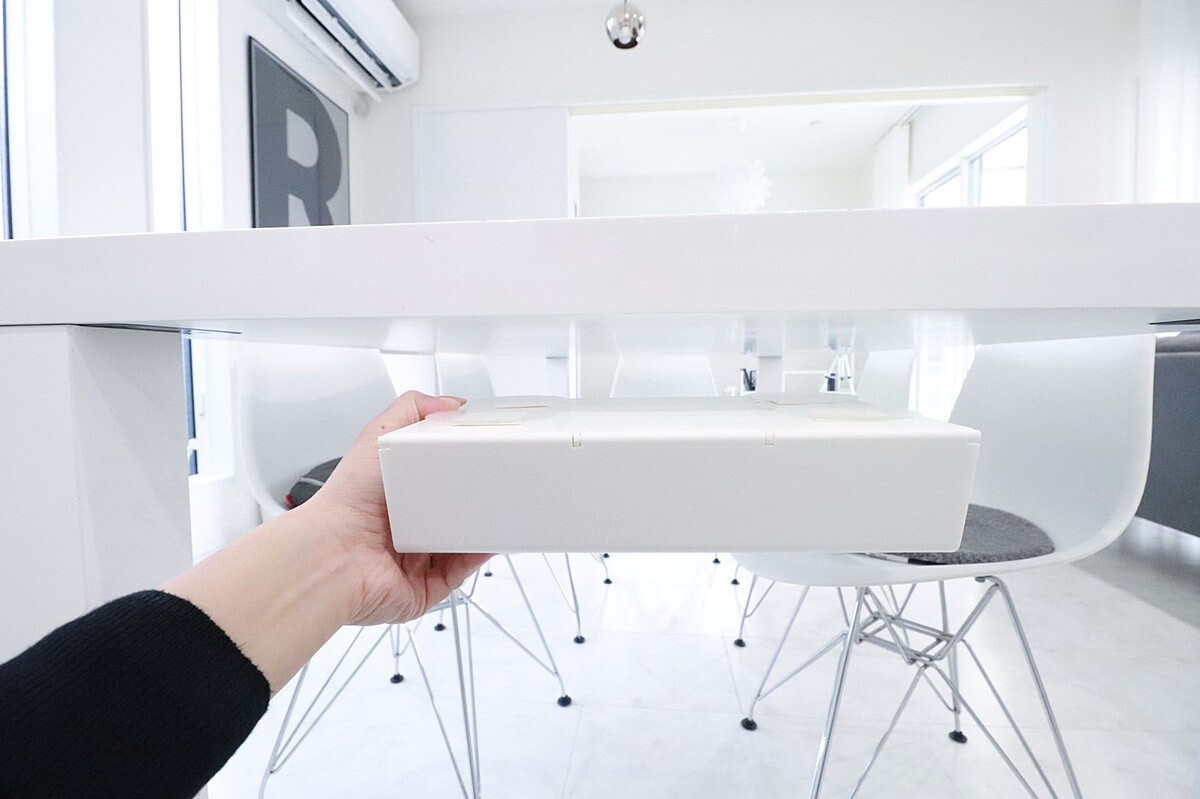

W48×D21×H76cm

天板/W48×D18

■重量

約1.5kg

■素材

チーク

■表面加工

エイジング仕上げ:ラッカー塗装

13000円ひなたライフ 立てかけコンソールテーブルインテリア/住まい/日用品机/テーブル重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

W48×D21×H76cmひなたライフ 立てかけコンソールテーブル - サイド

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

ひなたライフ 立てかけコンソールテーブル

ひなたライフ 立てかけコンソールテーブル

ひなたライフ 立てかけコンソールテーブル素材チーク - dso-ilb.si

ひなたライフ 立てかけコンソールテーブル素材チーク - dso-ilb.si

売れ筋オンライン ひなたライフ 立てかけコンソールテーブル - 机/テーブル

Hinata Life|【公式】インテリア雑貨の総合通販「ひなたライフ

W48×D21×H76cmひなたライフ 立てかけコンソールテーブル - サイド

ひなたライフ 立てかけコンソールテーブル素材チーク - dso-ilb.si

Comore Sun】チーク立てかけコンソールテーブル ワックス仕上げ

破格値下げ ひなたライフ 立てかけコンソールテーブル - 机/テーブル

ひなたライフ 立てかけコンソールテーブル素材チーク - dso-ilb.si

W48×D21×H76cmひなたライフ 立てかけコンソールテーブル - サイド

W48×D21×H76cmひなたライフ 立てかけコンソールテーブル - サイド

サイドテーブル|【公式】インテリア雑貨の総合通販「ひなたライフ

【当店オリジナル】シンプルで置く物を引き立てる、2本脚の立て掛け「コンソールテーブル」 #shorts

ひなたライフ 立てかけコンソールテーブルの通販 by あーたん's shop

寝室・クローゼット|【公式】インテリア雑貨の総合通販「ひなたライフ

重量約15kgひなたライフ 立てかけコンソールテーブル - コーヒー

ひなたライフ 立てかけコンソールテーブルの通販 by あーたん's shop

ローテーブル|【公式】インテリア雑貨の総合通販「ひなたライフ

ひなたライフ 立てかけコンソールテーブルの通販 by あーたん's shop

家具|【公式】インテリア雑貨の総合通販「ひなたライフ」-アプリNEW

ひなたライフ 立てかけコンソールテーブルの通販 by あーたん's shop

家具|【公式】インテリア雑貨の総合通販「ひなたライフ」-アプリNEW

家具|【公式】インテリア雑貨の総合通販「ひなたライフ」-アプリNEW

SALE価格 ひなたライフ 立てかけコンソールテーブル | badenbaden-net.com

豪華 ひなたライフ 立てかけコンソールテーブル | www.diesel-r.com

ひなたライフ 立てかけコンソールテーブルの通販 by あーたん's shop

売り切れ ひなたライフ 立てかけコンソールテーブル | franciscovilla.mx

家具|【公式】インテリア雑貨の総合通販「ひなたライフ」-アプリNEW

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています