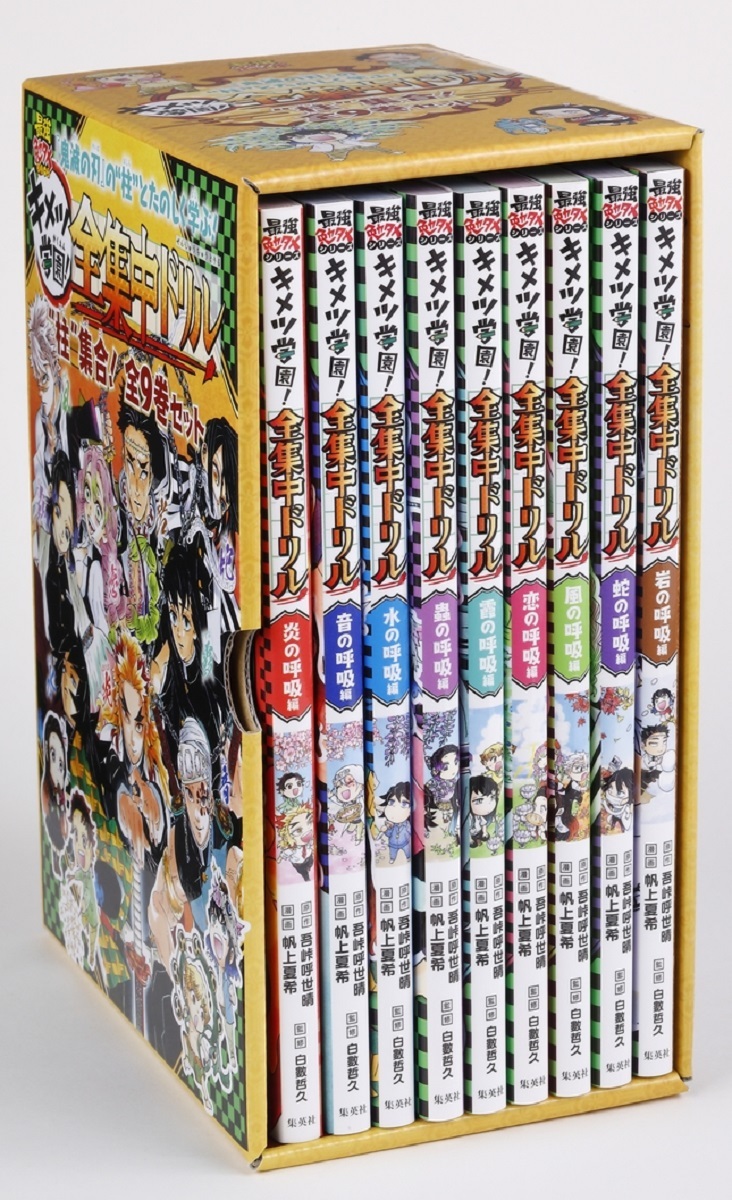

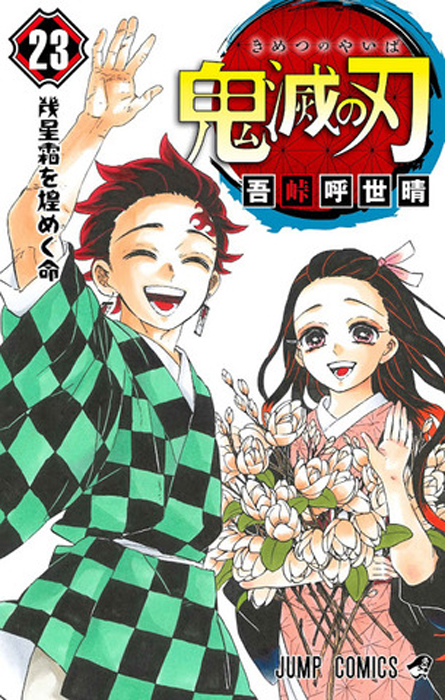

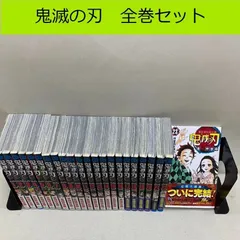

☆大人気☆鬼滅の刃 1~19巻セット

(税込) 送料込み

商品の説明

商品説明

ご覧いただきありがとうございます。全国で売り切れ続出❗️入荷未定❗️非常に入手困難❗️

新品未開封未読❗️シュリンク包装❗️

鬼滅の刃きめつのやいばキメツノヤイバ鬼滅ノ刃漫画本全巻セット1-19巻

【新品未開封】

フィルムが掛かったままの状態です。

【送料無料・匿名配送】

ご購入後24時間に発送させていただきます(*ᴗ͈ˬᴗ͈)⁾⁾⁾

☆お値下げ不可(人気商品在庫僅少の為)

☆即購入OK!早い者勝ち!

#吾峠呼世晴

#漫画

#マンガ

#COMIC

#コミックス

#鬼滅の刃

#きめつのやいば

#キメツノヤイバ

#鬼滅ノ刃

#きめつ

#鬼滅

#送料無料

#送料込

#全巻セット

#全巻

#まとめ売り

#少年ジャンプ

#集英社

6987円☆大人気☆鬼滅の刃 1~19巻セットエンタメ/ホビー漫画鬼滅の刃 1〜19巻 新品セット鬼滅の刃 - 全巻セット漫画大人気シリーズ 鬼滅の刃 きめつのやいば 全巻セット 1巻〜19巻 即

漫画大人気シリーズ 鬼滅の刃 きめつのやいば 全巻セット 1巻〜19巻 即

漫画大人気シリーズ 鬼滅の刃 きめつのやいば 全巻セット 1巻〜19巻 即

鬼滅の刃 1〜19巻 新品セット鬼滅の刃 - 全巻セット

鬼滅の刃 全巻セット【1〜19巻】漫画 - 全巻セット

鬼滅の刃 1〜19巻 新品セット鬼滅の刃 - 全巻セット

鬼滅の刃 全巻セット【1〜19巻】漫画 - 全巻セット

新品】鬼滅の刃 1〜19巻セット 全巻 全巻セット コミック 鬼滅の刃全巻

楽天市場】【新品シュリンク】鬼滅の刃 1〜23巻セット 全巻 全巻セット

Amazon.co.jp: 鬼滅の刃 19 (ジャンプコミックス) : 吾峠 呼世晴: 本

漫画鬼滅の刃 1-19 全巻セット - 全巻セット

Amazon.co.jp: 鬼滅の刃 19 (ジャンプコミックス) : 吾峠 呼世晴: 本

鬼滅の刃』最新刊19巻表紙公開!シリーズ累計発行部数4000万部突破

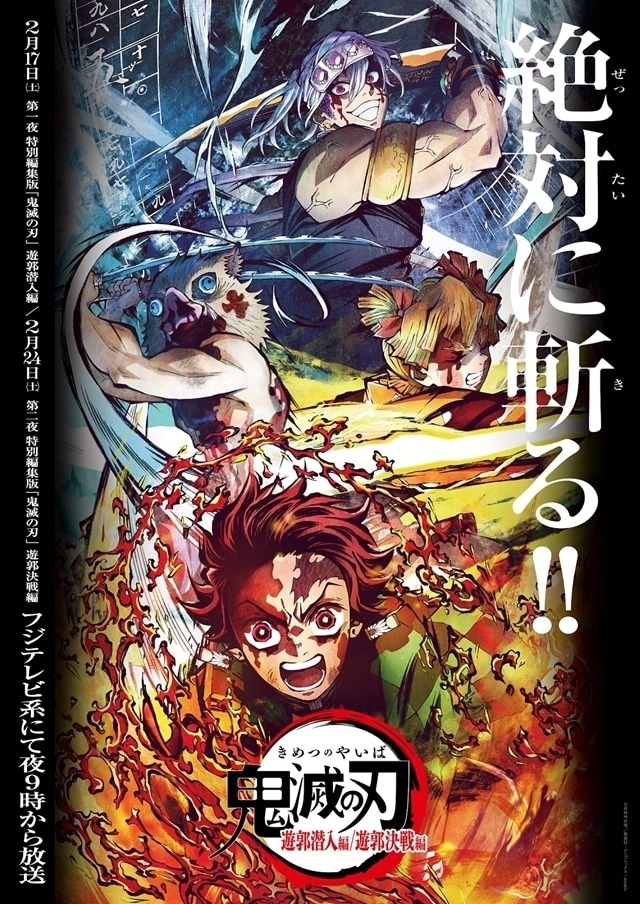

アニメ『鬼滅の刃』柱稽古編がテレビアニメ化決定!冨岡義勇・胡蝶

新品未使用】鬼滅の刃 1〜23巻 全巻セット 24時間以内発送鬼滅ノ刃

鬼滅の刃 漫画 1-19巻セットの通販 by ビュルビュル's shop|ラクマ

楽天市場】【新品シュリンク】鬼滅の刃 1〜23巻セット 全巻 全巻セット

鬼滅の刃 漫画 全巻 セット 特装版

鬼滅の刃 遊郭編(2期)|動画配信情報・2022冬アニメ最新情報一覧

鬼滅の刃 漫画 1-19巻セットの通販 by ビュルビュル's shop|ラクマ

楽天市場】【新品シュリンク】鬼滅の刃 1〜23巻セット 全巻 全巻セット

鬼滅の刃全巻セット 1〜19漫画 - 全巻セット

マンガ倉庫宮崎店】5/30□買取させていただきました!◇鬼滅の刃 1〜20

鬼滅の刃 漫画 1-19巻セットの通販 by ビュルビュル's shop|ラクマ

鬼滅の刃 1-19巻 新品セット | 吾峠 呼世晴 |本 | 通販 | Amazon

鬼滅の刃 全巻 と限定版

鬼滅の刃 コミック全巻

人気投票の1位から44位のキャラクターが登場!「『鬼滅の刃』つながる

2024年最新】鬼滅の刃全巻の人気アイテム - メルカリ

鬼滅の刃 19巻 | www.fleettracktz.com

楽天市場】【新品シュリンク】鬼滅の刃 1〜23巻セット 全巻 全巻セット

鬼滅の刃 漫画 1-19巻セットの通販 by ビュルビュル's shop|ラクマ

鬼滅の刃 1-19巻セット コミック漫画 単行本

人気ブランドの 鬼滅の刃 漫画 マンガ 1〜19巻セット | cci.unitru.edu.pe

鬼滅の刃 本 雑誌の人気商品・通販・価格比較 - 価格.com

2024年最新】鬼滅の刃 全巻の人気アイテム - メルカリ

鬼滅の刃 全巻セット【1〜19巻】漫画 - 全巻セット

鬼滅の刃|漫画全巻(完結まで)あらすじ まとめ | アニメイトタイムズ

鬼滅の刃」全23巻の累計発行部数が1億5000万部を突破! 初のぬり絵本も

鬼滅の刃 | 吾峠呼世晴 | Renta!

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています