16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

(税込) 送料込み

商品の説明

商品説明

16~17世紀古南蛮南蛮焼締片口擂鉢形菓子鉢灰入灰器花入れ花器ですとある旧家の蔵から出てきてくれた

南蛮の擂鉢状の作品です!

お箱もそのまま残っておりました!

16~17世紀にかけて中国南方系ベトナム

フィリピン諸島や沖縄の作品と考えますが

かなり古いお品です!

箱書きには【南蛮朱擂灰入】と箱書きされて

います!茶道具の灰器に使われたのでしょうか?

見所が沢山あるいまから400年前の

粘土を固め素焼きで焼き締めした素朴な

作品ですが

【これぞ骨董と感じさせられます!】

灰入れ灰器菓子鉢菓子器そして

花入れ花器何にでも使いこなせる

優れものです!お部屋のインテリアの一部と

して…オブジェとして…

主役となること間違いなしのお品です!

無傷!

経年の古擦れ汚れはございます

敢えてこのまま出品いたします!

ご理解ください!

径約20.9cm高さ約8.5cm

時代伝世箱附属

【Google検索❗️】はメルカリぽんちゃん

で…

NO.B220804401007NO2FR1TWKMW

#南蛮#古南蛮#鉢#大鉢#菓子鉢

#菓子器#灰入れ#灰器#睡蓮鉢

#めだか入れ#メダカ入れ#インテリア

#オブジェ#茶道具#茶器#花入れ

#花生け#華道#華道具#花器

#中国古陶磁器#中国古美術#中国南方系

#ベトナム古陶磁器#フィリピン古陶磁器

#琉球#古琉球#粘土#素焼き#焼き締め

#土器#須恵器#土師器#古備前

#古越前#古丹波#炻器#せっき

#南蛮貿易#呂宋#安南#古安南

カラー···ブラウン

種類···皿・鉢

22200円16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器エンタメ/ホビー美術品/アンティーク16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

2024年最新】#古琉球の人気アイテム - メルカリ

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

最先端 ◎古道具 庵々◎江戸時代 黒薩摩焼 壺◎茶道具酒器徳利花器壷古

ショッピング安い 三ツ井為吉 花瓶 2点セット 陶芸 s-a-a-d.com

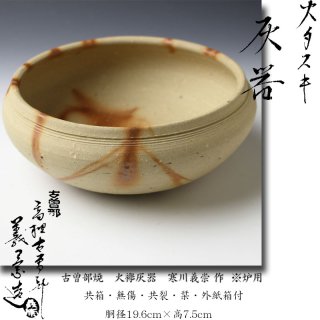

茶道具 灰器(はいき) 灰器 南蛮 炉用 太仙窯

☆海外限定☆ エンタメ/ホビー > 美術品/アンティーク > 陶芸 | 中古

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

焼き締め 片口 鉢 南蛮 古美術 古美術 古道具 アンティーク-

永楽即全 南蛮内渋灰器 eiraku, sokuzen nanban ash box | 古美術 山田

ショッピング安い 三ツ井為吉 花瓶 2点セット 陶芸 s-a-a-d.com

2024年最新】南方系の人気アイテム - メルカリ

祝開店!大放出セール開催中】 板谷波山作 辰砂茶碗 裏千家十四代

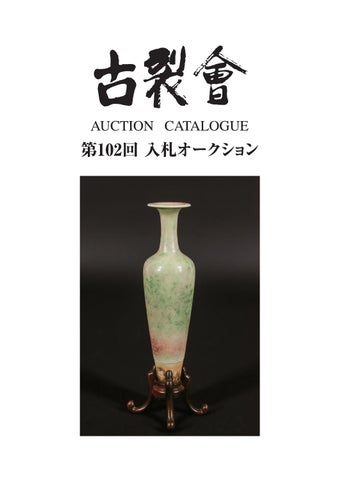

102nd KOGIRE-KAI Auction Catalog by KOGIRE-KAI - Issuu

南蛮花入 | 古美術ささき

お試し価格!】 抹茶碗 米色瓷 陶芸 - www.capitalconsignado.com.br

南蛮灰器 共箱 炉用 茶道具 - 陶芸

販売安心 中国 同治御製款 粉彩 花文 蓋碗 一對 F R5385 陶芸 s-a-a-d.com

灰器 -茶道具- 【古美術・茶道具 改野商店】

茶道具 平安朝日造 染付『山水風景祥瑞文』面取小鉢(九客) 豆皿 向付

16~17世紀 古南蛮 南蛮焼締 片口 擂鉢形 菓子鉢 灰入 灰器 花入れ 花器

2024年最新】南方系の人気アイテム - メルカリ

南蛮花入 | 古美術ささき

Yahoo!オークション -「南蛮焼」(日本の陶磁) (陶芸)の落札相場・落札価格

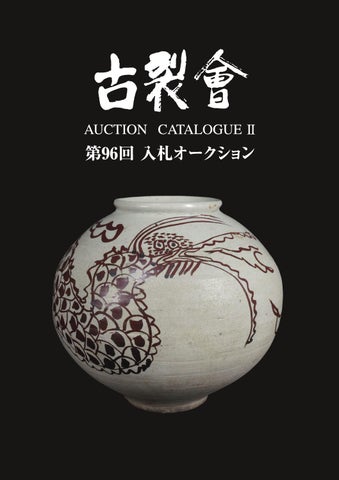

Kogire-kai 96th Tender Auction Catalog 2 by KOGIRE-KAI - Issuu

東中野 - 南蛮 粽花入 | 古美術品専門サイト fufufufu.com

売れ筋】 Dr.STONE ちびぐるみ 全5種 | www.capjc.tn

作家 はなクラフト 6寸輪花 縞鉢飴釉|和食器 四季折折 オンライン販売

茶道具 平安朝日造 染付『山水風景祥瑞文』面取小鉢(九客) 豆皿 向付

コヒーレント光通信工学/オーム社/大越孝敬オーム社サイズ - www

南蛮粽花入 江戸前期 - 夜噺骨董談義

スペシャルプライス らんま あかね セル画 A-3 maticanka.ba

茶道具 灰器(はいき) 灰器 南蛮 炉用 太仙窯

公式・限定 【名品】16c.~17c.頃 古南蛮系 南方系 灰釉 広口 壺

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています