【かーぷ様専用】クレイバースト151各1ボックス、シュリンク付+バラパック

(税込) 送料込み

商品の説明

商品説明

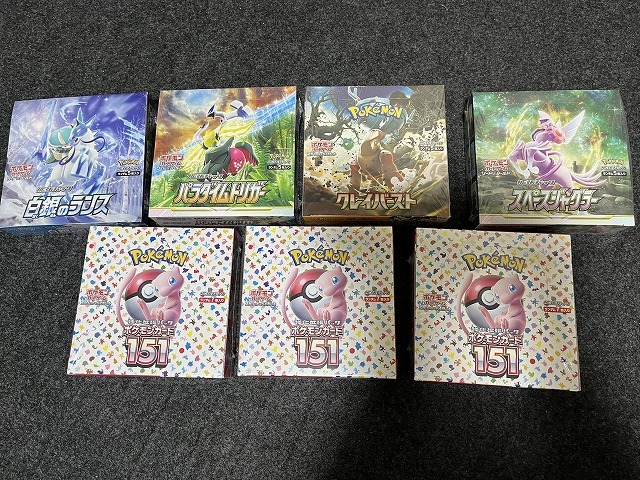

閲覧頂きありがとうございます。ポケモンカードクレイバースト、151シュリンク付各1boxとバラパック74パックです

バラパックは中身の封入率に偏りが出る可能性がございますので、中身の評価をする方は購入をお控え下さい。

すり替え防止の為、返品、返金、発送上のトラブル等一切受け付けませんので、ご理解頂けた方のみ購入をお願いします。

#ポケカ

#未開封ボックス

#トリプレットビート

#スカーレット

#Vユニ

#Vスターユニバース

#パラダイムトリガー

#イーブイヒーローズ

#psa10

#マリィ

#カイ

#バイオレット

#白熱のアルカナ

#ロストアビス

#クレイバースト

#スノーハザード

#ナンジャモセット

#ジムセット

#ポケモンカード

#リザードン

#キハダ

#ナンジャモ

#ナンジャモSR

#ナンジャモSAR

#レイジングサーフ

#チリ

#パラソルおねえさん

#SAR

22800円【かーぷ様専用】クレイバースト151各1ボックス、シュリンク付+バラパックエンタメ/ホビートレーディングカードポケモン - 【かーぷ様専用】クレイバースト151各1ボックスポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

【かーぷ様専用】クレイバースト151各1ボックス、シュリンク付+バラパック

【かーぷ様専用】クレイバースト151各1ボックス、シュリンク付+バラパック

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケカ バイオレットex クレイバースト スノーハザード シュリンク付

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケカ ボックス BOX 151 クレイバースト シュリンク付き ポケモン-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケカ バイオレットex クレイバースト スノーハザード シュリンク付

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケカ バイオレットex クレイバースト スノーハザード シュリンク付

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケカ バイオレットex クレイバースト スノーハザード シュリンク付

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケモンカードゲーム box まとめ売り 151 クレイバースト 4種 シュリンク付き 未開封

販売売り出し ポケモンカード 151 BOX シュリンク付き | mersolsureste

お買い得セール ポケカ バイオレットex 1box シュリンク付き

未開封 】ポケモンカード151 BOX バラパック+ ファイルセット2種-

ポケモンカード 151 クレイバースト BOX シュリンク付 ポケモンカード

クレイバースト、パラダイムトリガー、151、未開封シュリンク付きBOX-

ポケモンカード 151 クレイバースト BOX シュリンク付 ポケモンカード

販売取寄 ポケモン カード 151 シュリンク付きBOX | mersolsureste.com.mx

ポケモン - 【かーぷ様専用】クレイバースト151各1ボックス

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています