美品☆Snow Man 1stアルバム Snow Mania S1 3形態セット

(税込) 送料込み

商品の説明

商品説明

☆SnowMan☆Grandeur3形態セット

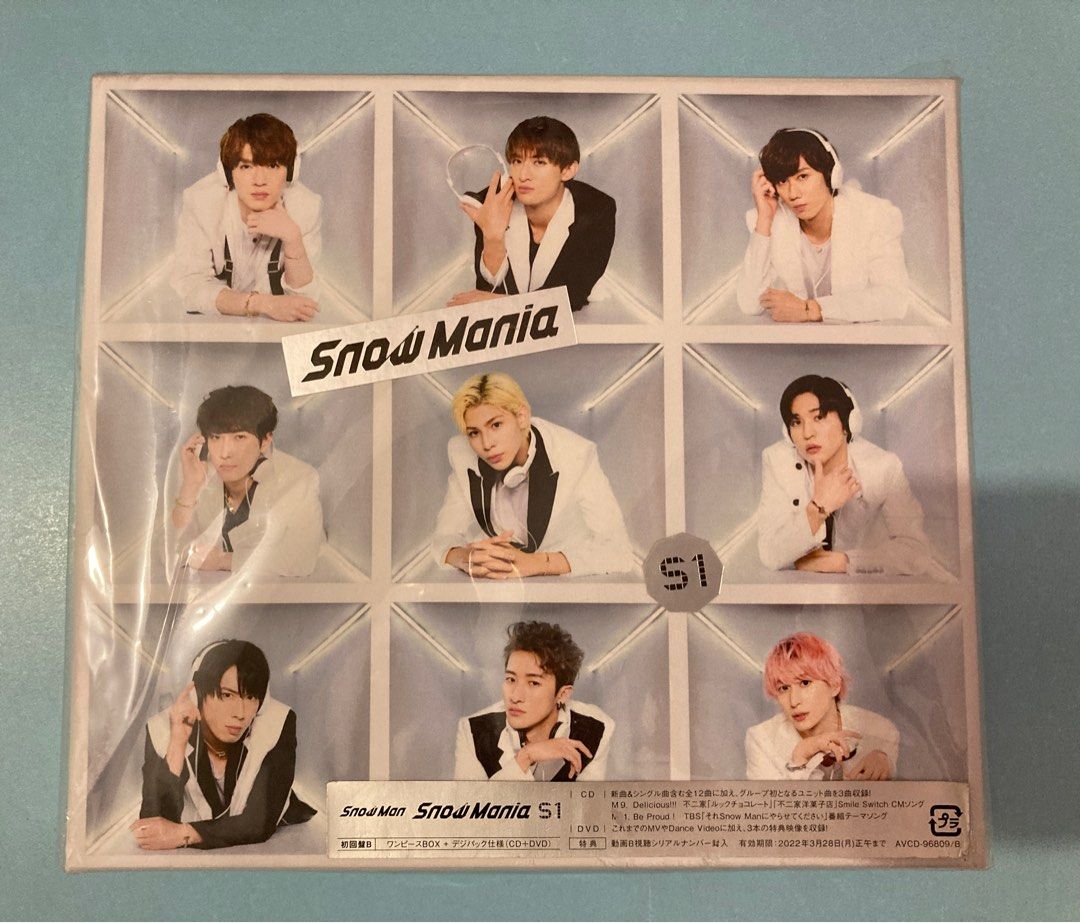

☆初回限定盤A

☆初回限定盤B

☆通常盤初回スリーブ仕様

3形態セットCD+Blu-rayセット

・それぞれに異なる楽曲が収録されており、しっかりSnowManをお楽しみいただけるかと思います☆

・出来る限りご確認いただけるように沢山写真付けております。

全体的にとても綺麗な状態かと思います!

初回限定盤に関しては、外袋に入れて丁寧に保管しておりますので、袋に少し使用感は当たり前かもしれませんが、ございますので、ご理解ください!

その他ディスクなどにもキズもなく状態は良いです!

おまけとして、SnowManカタログをお付けいたします!

付属品は写真にある物が全てでございます。

・ラクマパックにて送料無料、安心の匿名にて発送となります。

梱包についても、緩衝材で包み、お箱にて補強し丁寧に発送いたします!

・24時間以内に発送いたします。

宜しくお願い致します (*ᴗ͈ˬᴗ͈)⁾⁾⁾

#SnowMan#Snow_Man#CD・DVD

12805円美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットエンタメ/ホビーCD美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットSnow Man アルバム Snow Mania S1 3形態 | hartwellspremium.com

Snow Mania S1(DVD 3形態セット)-

Snow Mania S1 (CD+DVD)-

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セット

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットの通販 by

SnowMan 1st Album Snow Mania S1-

SnowMan SnowMania S1 アルバム 3形態-

SnowMan Snow Mania S1 DVD 3形態セット-

Snow Man Snow Mania S1 アルバム-

SnowMan 1st Album snowmania S1 3形態セット - www.sorbillomenu.com

SnowMan 1st Album Snow Mania S1-

SnowMan SnowManiaS1 3形態セット

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セット

早割クーポン! ☆美品・匿名発送☆Snow 邦楽 SnowMan S1(初回盤AとB

SnowMan Snow Mania S1 DVD 3形態セット-

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットの通販 by

SnowMan アルバム 「Snow Mania S1」3形態特典付き-

返品交換不可 SnowMania 3形態セット S1 S1 SnowMan Snow アルバム 1st

Snow Mania S1 初回盤☆2CD+DVD-

Snow Mania S1 3形態/ Mania DVD-

Snow Man 1stアルバム Snow Mania S1 3形態セット(CD+DVD)|Yahoo

お得セット SnowMan SnowMan Man 1stアルバムSnow S1 mania First S1

Snow Mania S1/SnowMan 3形態-

SnowMan 1st Album snowmania S1 3形態セット - www.sorbillomenu.com

❄︎SnowMan アルバム Snow Mania S1 初回盤A❄︎-

SnowMan 1stアルバム Snow Mania S1-

SnowMan アルバム Snow Mania3形態セット-

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットの通販 by

Snow Man 1st album 「Snow Mania S1」 初回盤B-

12222 円 雑誌で紹介された Snow www Man Man Snow 3形態 Snow tic

Snow Man スノマニ Mania S1 1st アルバム-

2022春夏新色】 Mania Snow S1 3形態セット カタログ付き 邦楽 - www

SnowMan 1st Album Snow Mania S1-

極美 Snow Man 1st ALBUM 『Snow Mania S1』初回盤B -アイドル

Snow Man Snow Mania S1 アルバム Bluray-

SnowMan 1st Album Snow Mania S1-

美品☆Snow Man 1stアルバム Snow Mania S1 3形態セットの通販 by

シニアファッション SnowMan 未開封アルバム+特典3形態セットの

Snow Mania S1 3形態/ Mania DVD-

人気激安 Snow Mania SnowMan / CD2+Blu-ray 初回盤A S1 邦楽 - www

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています