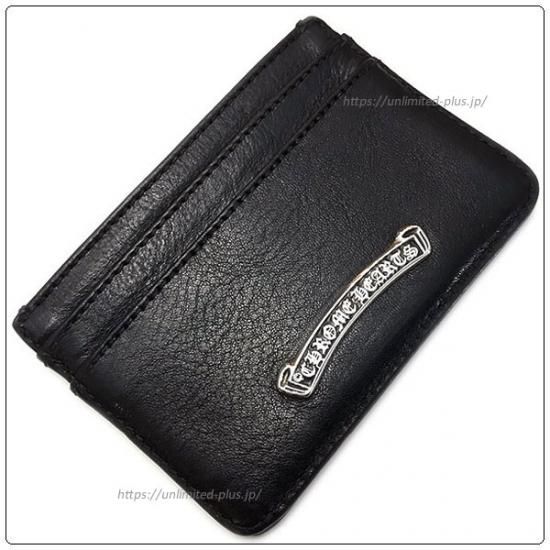

自身購入‼️クロムハーツ 名刺入れ カードケース 正規店購入

(税込) 送料込み

商品の説明

商品説明

クロムハーツカードケース名刺入れ限定7年ほど前にCHROMEHEARTSTOKYOで購入しました。

当時5万円くらいしました。

保証書などは紛失してしまっております。

3年ほど使用し使うことがなさそうなのでつかっていただける方に。

使用感や、少し角すれはございますが、まだまだお使いいただけます。

12098円自身購入‼️クロムハーツ 名刺入れ カードケース 正規店購入メンズファッション小物クロムハーツ カードケース名刺入れ-自身購入‼️クロムハーツ 名刺入れ カードケース 正規店購入

CHROME HEARTS クロムハーツ カードケース 名刺入れ 財布 インボイス

Chrome Hearts†超希少品†クロスカードウォレット (CHROME HEARTS

クロムハーツ カードケース名刺入れ-

クロムハーツ カードケース名刺入れ-

CHROME HEARTS クロムハーツ カードケース 名刺入れ 財布 インボイス

クロムハーツ/CHROME HEARTS カードケース #2 グロメット、2種類で在庫

CHROME HEARTS クロムハーツ カードケース 名刺入れ 財布 インボイス

クロムハーツ Chrom hearts 名刺入れ カードケース ブラック

CHROME HEARTS クロムハーツ カードケース 名刺入れ 財布 インボイス

Chrome Hearts Scroll CardCase クロムハーツ カードケース (CHROME

クロムハーツ カードケース名刺入れ-

クロムハーツ Chrom hearts 名刺入れ カードケース ブラック

クロムハーツ CHROME HEARTS カードケース-

クロムハーツ CHROME HEARTS カードケース-

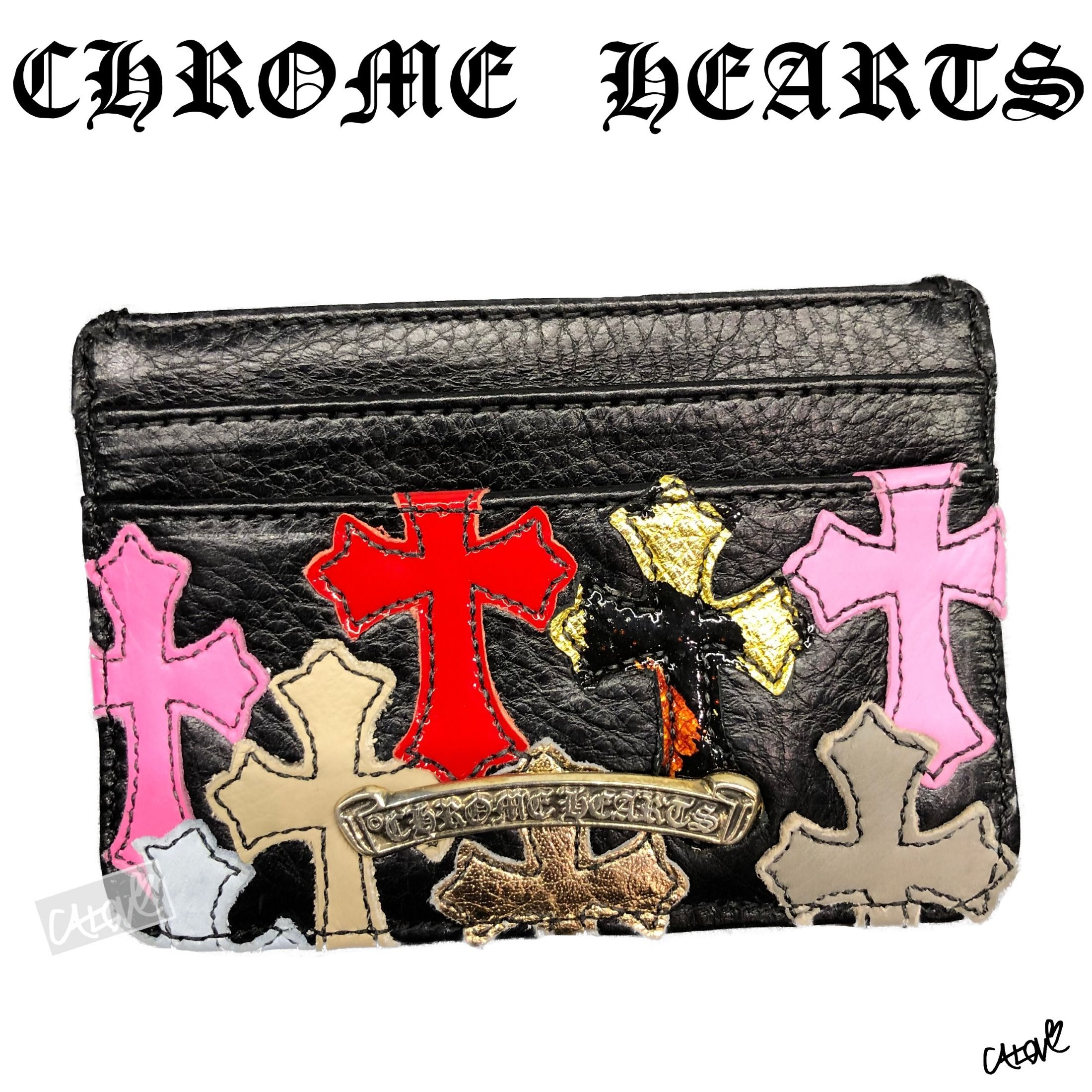

◇レア十クロムハーツ十【マルチカラーパッチ/カードケース】十

クロムハーツ カードケース名刺入れ-

クロムハーツ カードケース,名刺入れも入荷致しております

CHROME HEARTS コインケース 小銭入れウォレット 財布

クロムハーツ カードケース名刺入れ-

入荷!クロムハーツ財布、カードケース #2 グロメット スクロール

クロムハーツ CHROME HEARTS カードケース-

クロムハーツ CHROME HEARTS パスポートケース

Chrome Hearts クロムハーツ One Trillion ワントリリオン Black

CHROME HEARTS クロムハーツ カードケース 名刺入れ 財布 インボイス

クロムハーツ CHROME HEARTS カードケース-

クロムハーツ CHROME HEARTS パスポートケース

クロムハーツ ビニールカードケース (CHROME HEARTS/カードケース

クロムハーツ CHROME HEARTS カードケース-

入荷!クロムハーツ カードケース、カードケースV1 3ポケット タンク

CHROME HEARTS (クロムハーツ) カードケース・名刺入れ メンズ

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

クロムハーツ 名刺入れ/定期入れ(メンズ)の通販 93点 | Chrome Hearts

クロムハーツ 財布、カードケース 店頭にタンクカモレザー(海外限定

クロムハーツ 革 名刺入れ/定期入れ(メンズ)の通販 9点 | Chrome

クロムハーツ CHROME HEARTS カードケース-

クロムハーツ Chrom hearts 名刺入れ カードケース ブラック

本日入荷!クロムハーツ財布 / ウェーブ、カードケース 3ポケット、#2

クロムハーツレザーカードケース#2ブラック|クロムハーツ通販専門店

クロムハーツ CHROMEHEARTS カードケース 名刺入れ タンクカモ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています