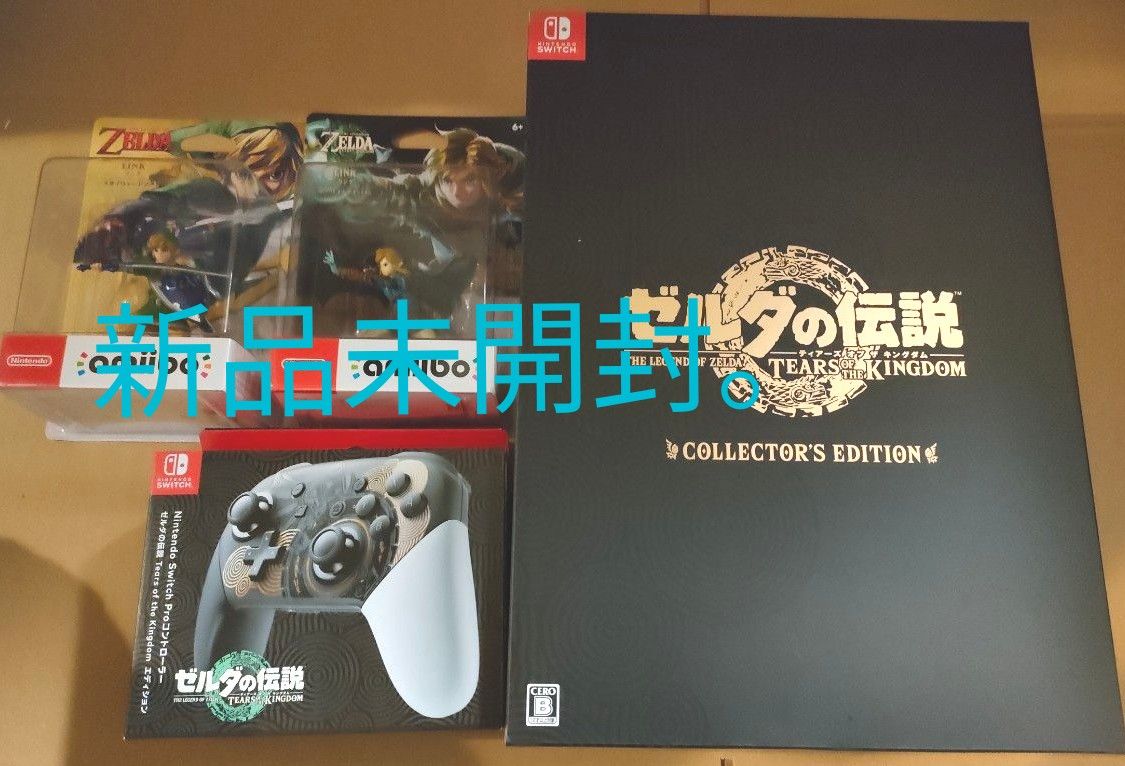

Nintendo Switch Proコントローラー ゼルダの伝説〈未開封〉

(税込) 送料込み

商品の説明

商品説明

5月12日発売ゼルダの伝説

ティアーズオブザキングダム仕様

NintendoSwitchProコントローラー

新品未開封

長時間でも持ちやすく、

TVモードやテーブルモードのゲームが快適にプレイできるグリップ型の

ワイヤレスコントローラーです。

【セット内容】

・NintendoSwitchProコントローラー(ゼルダの伝説ティアーズオブザキングダム仕様)×1

・USB充電ケーブル×1

即購入OK

値下げ対応不可

保証書〈外箱〉+納品書

ゆうパケットプラスにて

発送予定です。

5950円Nintendo Switch Proコントローラー ゼルダの伝説〈未開封〉エンタメ/ホビーゲームソフト/ゲーム機本体誠実 【新品未開封】ゼルダの伝説 Switch Proコントローラー プロコンプロコン ゼルダの伝説 ティアーズオブザキングダム NintendoSwitch Proコントローラー 任天堂純正 プロコントローラー : 4902370550504 : ゴマショップ Yahoo!店 - 通販 - Yahoo!ショッピング

お試し価格! ゼルダの伝説 オブ Proコントローラー テレビゲーム

新品・未開封 Nintendo SWITCH PROコントローラー ゼルダの伝説

誠実 【新品未開封】ゼルダの伝説 Switch Proコントローラー プロコン

ゼルダの伝説 ティアーズ オブ ザ キングダム プロコン ケース 新品未開封-

ゼルダの伝説 ティアーズ オブ ザキングダムエディション プロコン

最安挑戦! メルカリ 純正 Switch 2024年最新】switch プロコン - 純正

任天堂 Nintendo Switch 新品未開封 コントローラー プロコン

直売超高品質 Nintendo Switch プロコントローラー ゼルダの伝説 Pro

セールの定価 【新品未開封】任天堂 プロコン ゼルダの伝説 Pro

ゼルダの伝説 Proコントローラー-

Nintendo Switch Proコントローラー ゼルダの伝説 ティアーズ オブ ザ

有名なブランド 即日発送 新品未開封 スイッチ プロコン ゼルダの伝説

新品☆ニンテンドースイッチ プロコントローラー ゼルダの伝説-

手数料安い 【新品未開封】純正 Proコントローラー プロコン ゼルダの

新品・未開封】ゼルダの伝説 プロコン-

全品新品未開封 ゼルダの伝説 ティアーズオブザキングダム

おトク 【新品、未開封】 Switch Proコン ゼルダの伝説 エディ… Pro

直売卸値 Proコントローラー ゼルダの伝説 ティアーズ オブ ザ

Nintendo Switch Proコントローラー ゼルダの伝説エディション 未使用

2024年最新】Nintendo Switch Proコントローラー ゼルダの伝説

ゼルダの伝説 ティアーズ オブ ザキングダムエディション プロコン

ゼルダの伝説 ティアーズ オブ ザ キングダム」モデルのProコン+専用

新品未開封 Nintendo switchプロコン ゼルダの伝説|Yahoo!フリマ(旧

ご購 ゼルダの伝説 プロコン Nintendo Switch Proコントローラー

未開封 Proコントローラー ゼルダの伝説ティアーズオブザキングダム

プロコン ゼルダの伝説 ティアーズ オブ ザ キングダム ティアキン

任天堂 Nintendo Switch Proコントローラー ゼルダの伝説 ティアーズ

安値 Nintendo Switch Proコントローラ ゼルダの伝説 エディション

オンライン価格 Switch Proコントローラー ゼルダの伝説 プロコン 新品

メーカー公式ショップ ゼルダの伝説 プロコン Nintendo Switch Pro

ゼルダの伝説 ティアーズ オブ ザ キングダム プロコン ケース 新品未開封-

switch ゼルダの伝説 Tears of the Kingdom amiibo×2 pro

Nintendo Switch - 【新品・未開封】Nintendo Switch Pro

送料無料!!! Nintendo Switch Proコントローラー ゼルダの伝説

1円 Nintendo Switch Proコントローラー ゼルダの伝説 ティアーズ オブ

新品未開封】Switch Proコントローラー ゼルダ プロコン ティアキン

任天堂 Nintendo Switch Proコントローラー ゼルダの伝説 ティアーズ

Nintendo Switch Proコントローラー ゼルダの伝説 Tears of the

新品未開封】Nintendo Switch Proコントローラー ゼルダの伝説

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています