me(ミー/イッセイミヤケ) カーディガン -

(税込) 送料込み

商品の説明

商品説明

[カテゴリ]カーディガン

[ブランド]

me(ミー/イッセイミヤケ)

[商品名]

-

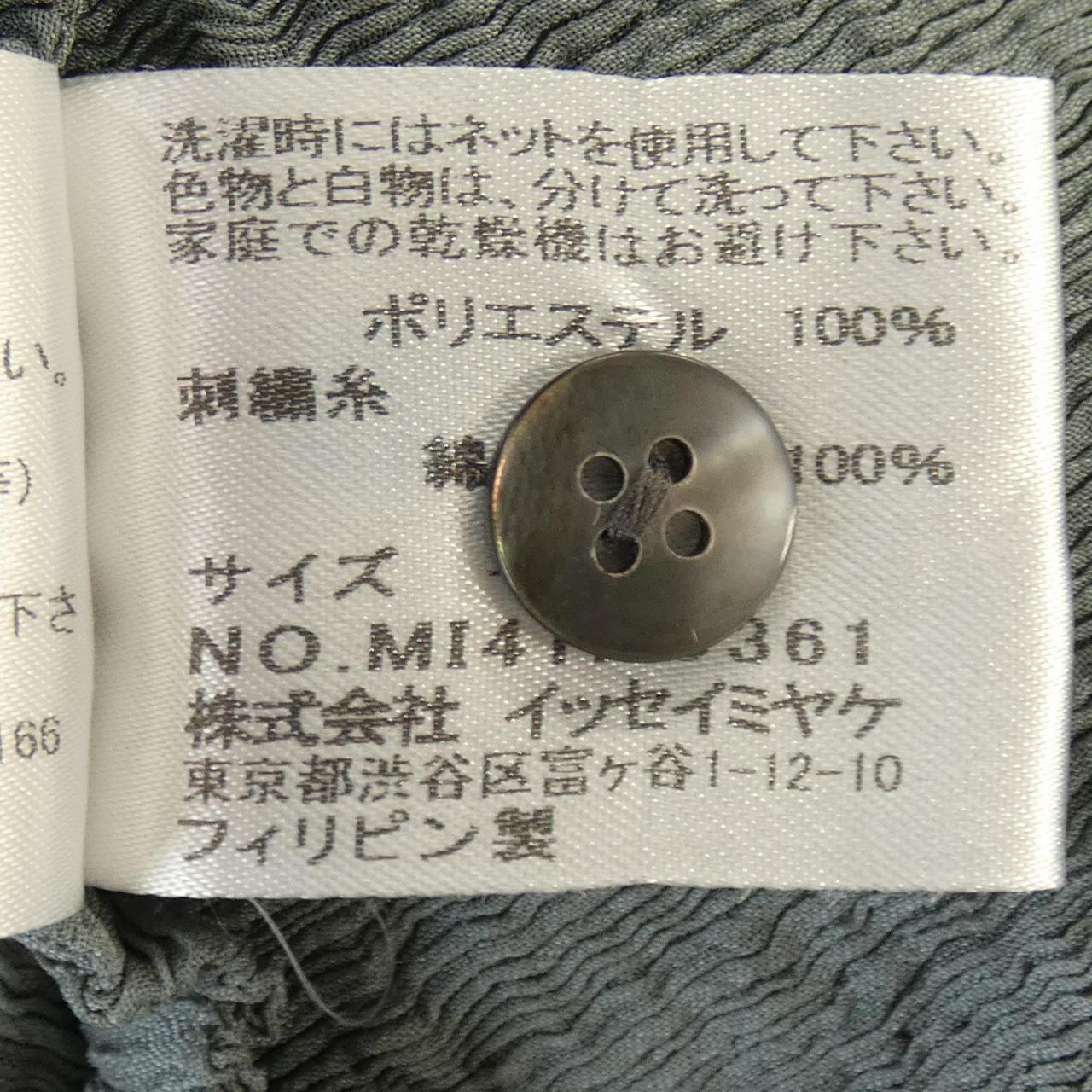

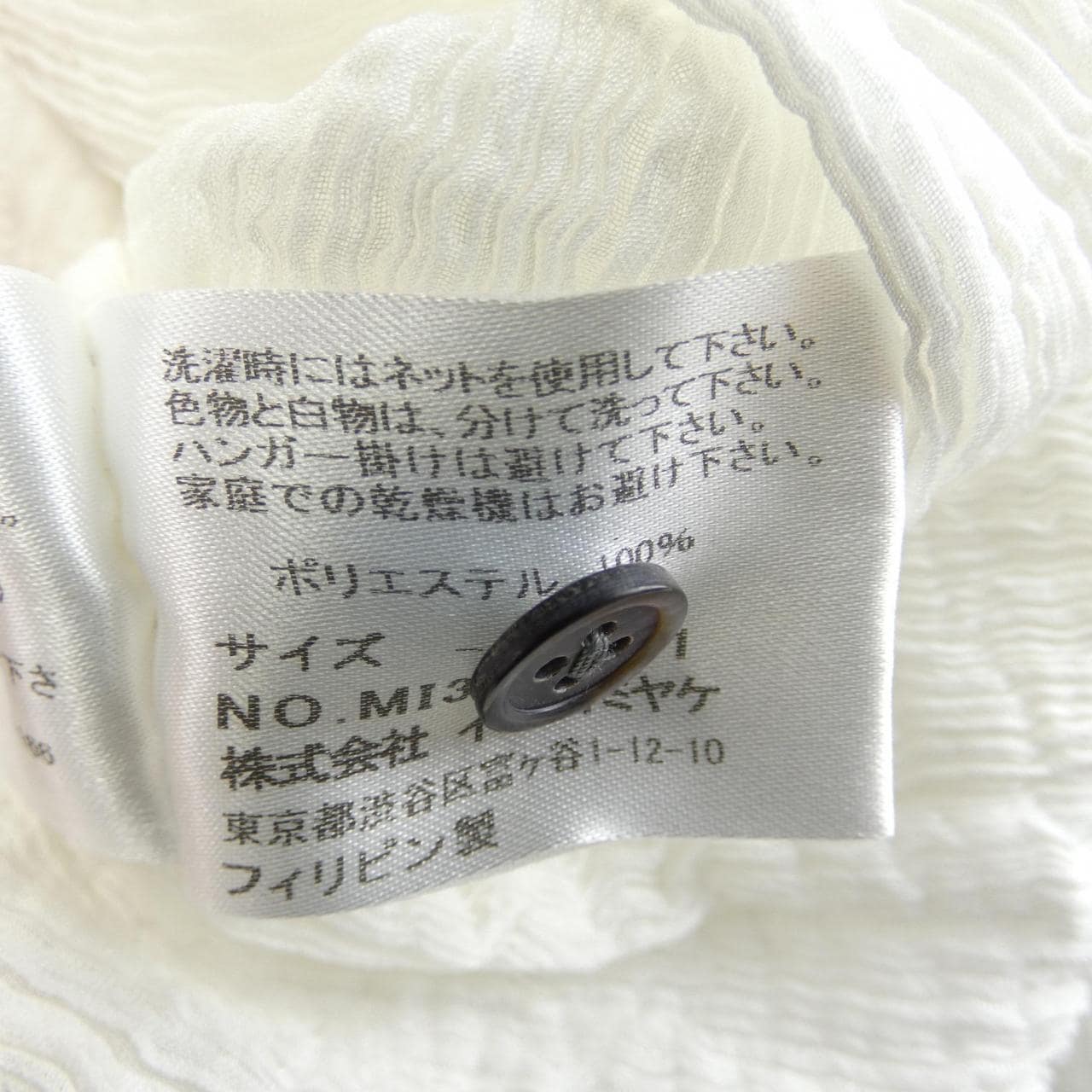

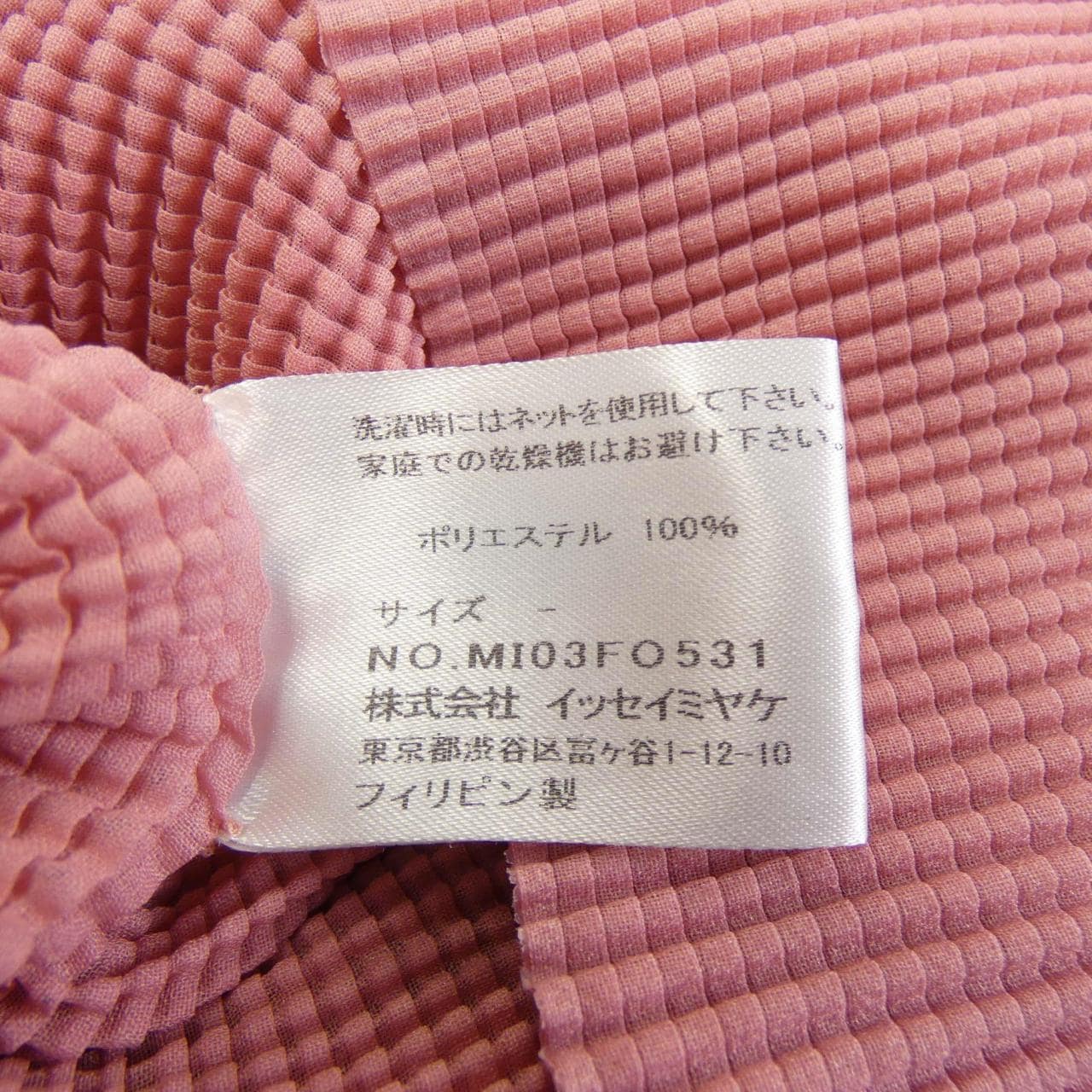

[型番]

-

[男女別]

レディース

[実寸サイズ]

肩幅:約30cm

袖丈(ゆき丈):約50cm

身幅:約45cm

着丈:約50cm

[カラー]

黒×白

[デザイン]

長袖/シワ加工/チェック柄

表記サイズなし

[コンディションの備考]

【本体】

・全体的⇒ヨレ目立つ

[製造番号・刻印]

-

[シリアル]

***

[付属品]

なし

こちらの商品はラクマ公式パートナーのBrandear(ブランディア)によって出品されています。

以下の内容のお問い合わせについてはお返事ができませんのであらかじめご了承ください。

・商品状態の確認(汚れ具合、形状の確認等々)

・お値下げの交渉

6565円me(ミー/イッセイミヤケ) カーディガン -レディーストップスミーイッセイミヤケ me ISSEY MIYAKE カーディガン付属情報についてミー/イッセイミヤケ カーディガン -レディース - カーディガン

ミーイッセイミヤケ me ISSEY MIYAKE カーディガン付属情報について

約49cm身幅me ISSEY MIYAKE カリフラワー カーディガン ミー イッセイ

ミーイッセイミヤケ me ISSEY MIYAKE カーディガン付属情報について

カーディガンイッセイミヤケミー カーディガン - カーディガン

楽天市場】【中古】ミーイッセイミヤケ me ISSEY MIYAKE カリフラワー

me(ミー/イッセイミヤケ) カーディガン -の+nuenza.com

ミー イッセイミヤケ (me ISSEY MIYAKE) ポリエステル ストレッチ

♪♪ISSEY MIYAKE イッセイミヤケ Me ミー カーディガン ワッフル

me ISSEY MIYAKE(ミーイッセイミヤケ) FINE KNIT PLEATS プリーツ

中古・古着通販】me ISSEY MIYAKE (ミーイッセイ ミヤケ) カリフラワー

コメ兵|ミーイッセイミヤケ me ISSEY MIYAKE カーディガン|ミー

プリーツプリーズISSEY MIYAKE me フリンジカーディガン

コメ兵|ミーイッセイミヤケ me ISSEY MIYAKE カーディガン|ミー

大切な イッセイミヤケme 楽天市場】me MIYAKE ミー イッセイミヤケ

中古・古着通販】me ISSEY MIYAKE (ミーイッセイ ミヤケ) カリフラワー

中古】 ISSEY MIYAKE イッセイミヤケ me ミー レディース ワッフル

ミーイッセイミヤケ me ISSEY MIYAKE カーディガン付属情報について

ご注意くださいミーイッセイミヤケ me ISSEY MIYAKE カーディガン

製造 ミー イッセイミヤケ me ISSEY MIYAKE 2023年春夏 プリーツ加工

楽天市場】【中古】ミー イッセイミヤケ me ISSEY MIYAKE 2023年秋冬

イッセイミヤケmeカーディガン-

コメ兵|ミーイッセイミヤケ me ISSEY MIYAKE カーディガン|ミー

me(ミー/イッセイミヤケ) カーディガン -の+nuenza.com

ミーイッセイミヤケ me ISSEY MIYAKE カーディガン 長袖 緑 - カーディガン

中古・古着通販】me ISSEY MIYAKE (ミーイッセイ ミヤケ) プリーツ

イッセイ ミヤケ meのカーディガン-

直営 me ISSEY MIYAKE ミーイッセイミヤケ トップス レディース

制服 me ISSEY MIYAKE ミーイッセイミヤケ カーディガン ブラック黒

ずっと愛用したいデイリーブランド「ミー イッセイ ミヤケ」のこだわり

海外受注発注品 ミー/イッセイミヤケ カーディガン - 長袖 | skien

予約販売も ミー イッセイミヤケ me ISSEY MIYAKE 2023年秋冬 プリーツ

me ISSEY MIYAKE カーディガン-

605cm着幅

me ISSEY MIYAKE ミー イッセイ ミヤケ/カーディガン特別セール品 me(ミー/イッセイミヤケ) カーディガン - | make.lt

トップスme(ミー/イッセイミヤケ) カーディガン - - カーディガン

ISSEY MIYAKE - ミーイッセイミヤケ me ISSEY MIYAKE カーディガンの+

ミー イッセイミヤケ me ISSEY MIYAKE 2023年秋冬 プリーツ ブラウス

予約販売】本 【me ISSEY MIYAKE】ミーイッセイミヤケ カリフラワー

ミーバイイッセイミヤケ me ジャケット カーディガン 白-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています