MUSE de Deuxieme Classe SINGLE JACKET

(税込) 送料込み

商品の説明

商品説明

MUSEdeDeuxiemeClasseSINGLEJACKET

¥70,400

ベージュ

フリーサイズ

未使用品

試着のみ

薄手のウール素材で春先にTシャツの上からさらっと羽織りたいジャケット。ヒップがすっぽりと隠れる長めの着丈ながら、細身のシルエットですっきりと着て頂けるデザイン。ストレッチが効いた生地感のため、ノンストレスな着心地も魅力です。細身のパンツはもちろん、マキシスカートともバランスが取りやすい絶妙なシルエットはCorpierrotならではの1着。柔らかな色を活かしたニュアンスカラーのスタイリングもおすすめです。

サイズ

肩幅約37cm、身幅約51cm

着丈約75-77cm、袖丈約59cm

*平置き採寸、若干の誤差はご了承ください

◆注意事項◆

新品の物でも一度は人手に渡った物になります。

検品していますが、素人出品ですので見落としもあるかもしれません。

完璧を求める方、細かなことが気になる方はご遠慮願います。

発送は自宅内にあるもので梱包し、コンパクトにさせていただきますのでご了承ください。

発送方法はこちらで選択し発送いたします

L'AppartementDeuxieme

アパルトモン

DeuxiemeClasse

ドゥーズィエムクラス

plage

プラージュ

APSTUDIO

エーピースタジオ

ELENDEEK

エレンディーク

FILLTHEBILL

フィルザビル

エリン

UNITEDARROWS

アローズ

BEAUTY&YOUTH

ビューティ&ユース

TOMORROWLAND

トゥモローランド

MACPHEE

マカフィー

RonHerman

ロンハーマン

金子綾

18300円MUSE de Deuxieme Classe SINGLE JACKETレディースジャケット/アウターMUSE de Deuxieme Classe SINGLE JACKETMUSE de Deuxieme Classe SINGLE JACKET

MUSE de Deuxieme Classe SINGLE JACKET

期間限定20%OFF!】2021SS ドゥーズィエムクラス MUSE de Deuxieme

MUSE de Deuxieme Classe SINGLE JACKET

Tweed Single ジャケット(ノーカラージャケット)|MUSE de Deuxieme

2021SS ドゥーズィエムクラス MUSE de Deuxieme Classe Col Pierrot

MUSE de Deuxieme Classe SINGLE JACKET 最終値下げ 49.0%割引 www

DEUXIEME CLASSE - MUSE de Deuxieme Classe SINGLE JACKETの通販 by

MUSE de Deuxieme Classe SINGLE JACKET - ロングコート

Tweed Single ジャケット(ノーカラージャケット)|MUSE de Deuxieme

Muse Announce Title, Release Date For 9th Album, 'Will of the People'

MUSE de Deuxieme Classe SINGLE JACKET - ロングコート

muse/news Archives - SAMBlog

2021SS ドゥーズィエムクラス MUSE de Deuxieme Classe Col Pierrot

2021 / Col Pierrot コルピエロ / SINGLE JACKET シングルジャケット

DEUXIEME CLASSE - MUSE de Deuxieme Classe SINGLE JACKETの通販 by

MUSE de Deuxieme Classe SINGLE JACKET ミューズドゥドゥーズィエム

Analysis: Fan Theories Make Canon Connections To 'Star Trek

Rock Band Muse Signs With UTA

Tweed Single ジャケット(ノーカラージャケット)|MUSE de Deuxieme

本格的なサウンドの-ミューズ ドゥ• ドゥーズィエム クラス MUSE de

2021 / Col Pierrot コルピエロ / SINGLE JACKET シングルジャケット

Travel small-talk with Margarita! | Clio Muse Tours

Women's Milly Designer Coats & Jackets | Saks Fifth Avenue

20 Famous Coats in Films - Iconic Movie Coats

MUSE de Deuxieme Classe SINGLE JACKET - ロングコート

MUSE de Deuxieme Classe(ドゥーズィエムクラス) ジャケット

Matty Matheson: The behind-the-scenes leader who perfects the

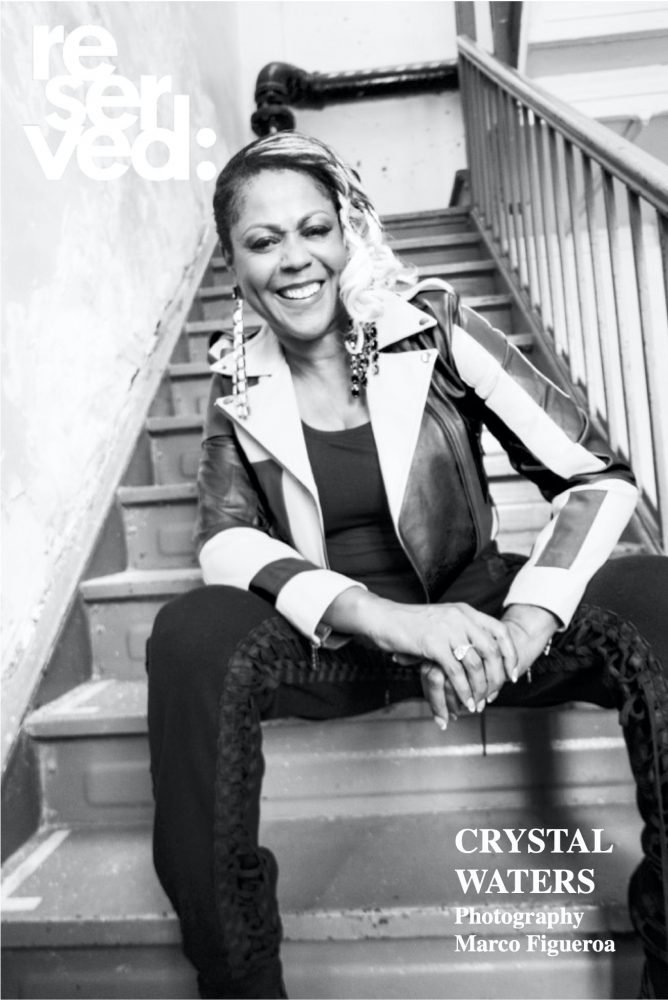

Crystal Waters | Crystal Clear - Reserved Magazine

MUSE de Deuxieme classe(ミューズデドゥーズィエムクラス)の

The 10 Best Rappers of the 2000s | Complex

MUSE de Deuxieme Classe (ミューズ ドゥーズィエム クラス) フルジップブルゾン キャメル サイズ:-

René Magritte - Wikipedia

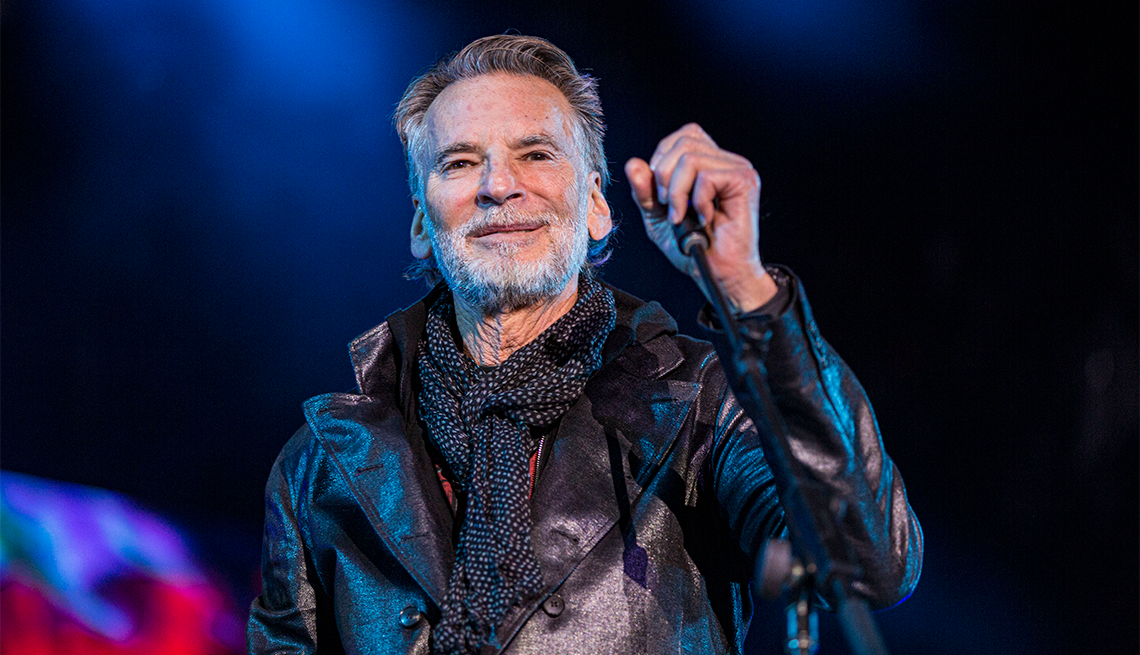

Kenny Loggins Talks About His Farewell Tour

Drones

Muse Couple of the Week: Lily Lane and Joe Pascoe – BOY MEETS GIRL USA

Single All the Way (2021) - News - IMDb

Movies on TV this week Sept. 15, 2019: 'Alien,' 'Aliens' and more

本格的なサウンドの-ミューズ ドゥ• ドゥーズィエム クラス MUSE de

MUSE de Deuxieme Classe SINGLE JACKET - ジャケット/アウター

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

_le_18_octobre_1961_devant_une_de_ses_toiles_La_persp,_PH19994.jpg/1200px-Portrait_en_buste_du_peintre_surréaliste_René_Magritte_(1898-1967)_le_18_octobre_1961_devant_une_de_ses_toiles_La_persp,_PH19994.jpg)