送料込 長場雄 イーブイ プロモ カード コンプリートセット 2セット ブイズ

(税込) 送料込み

商品の説明

商品説明

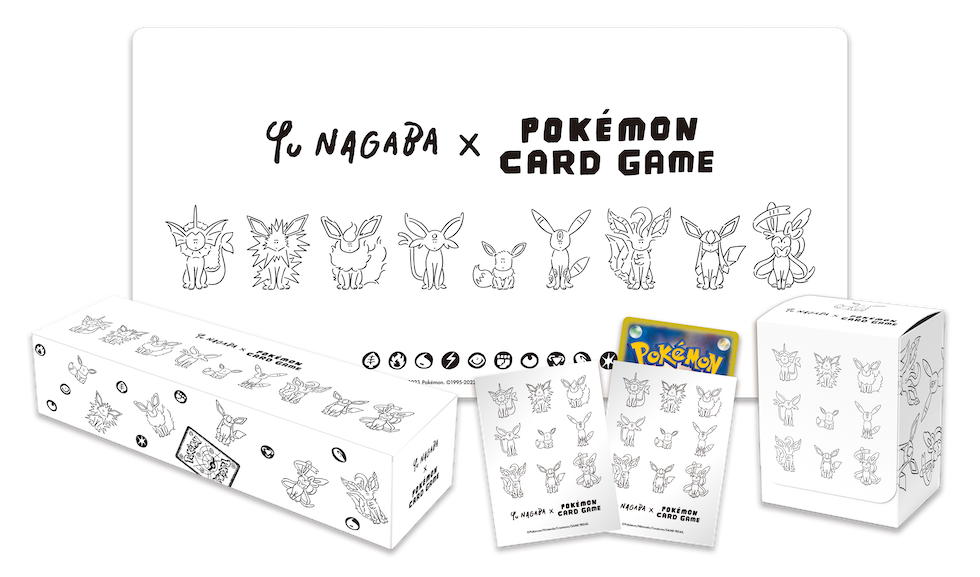

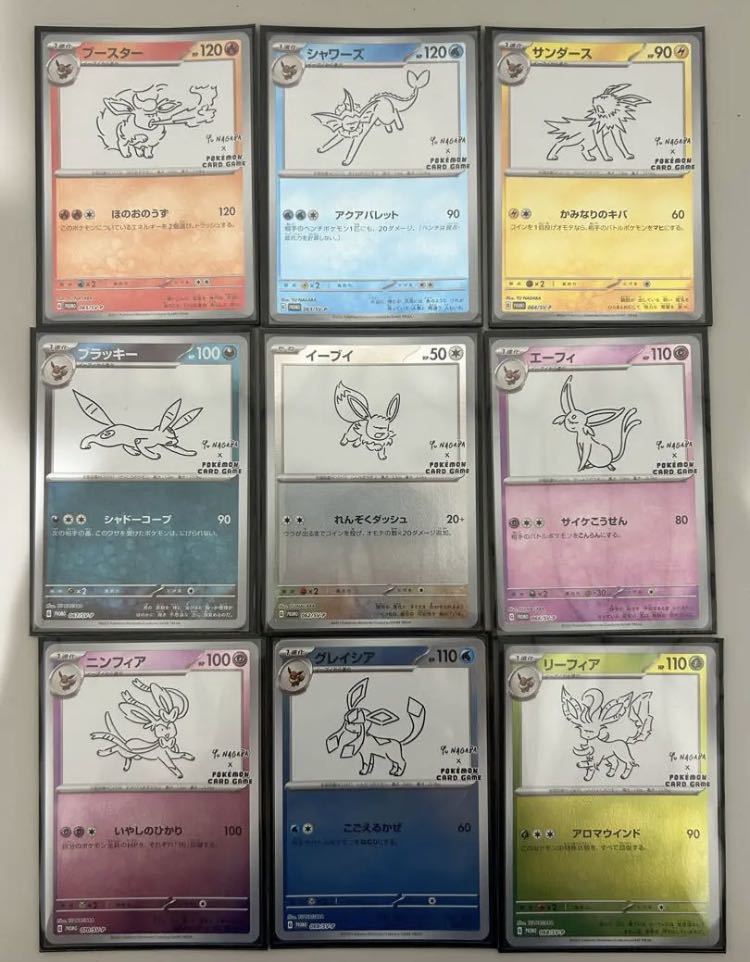

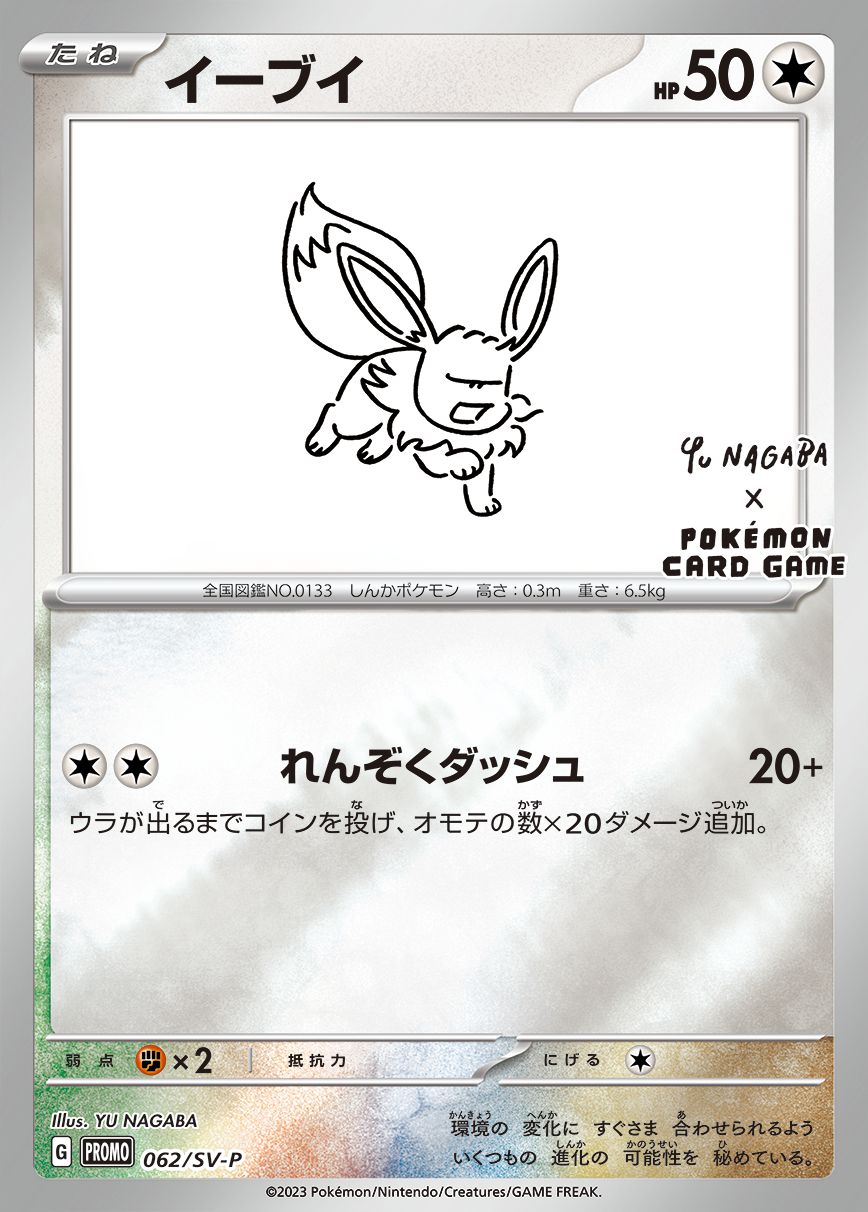

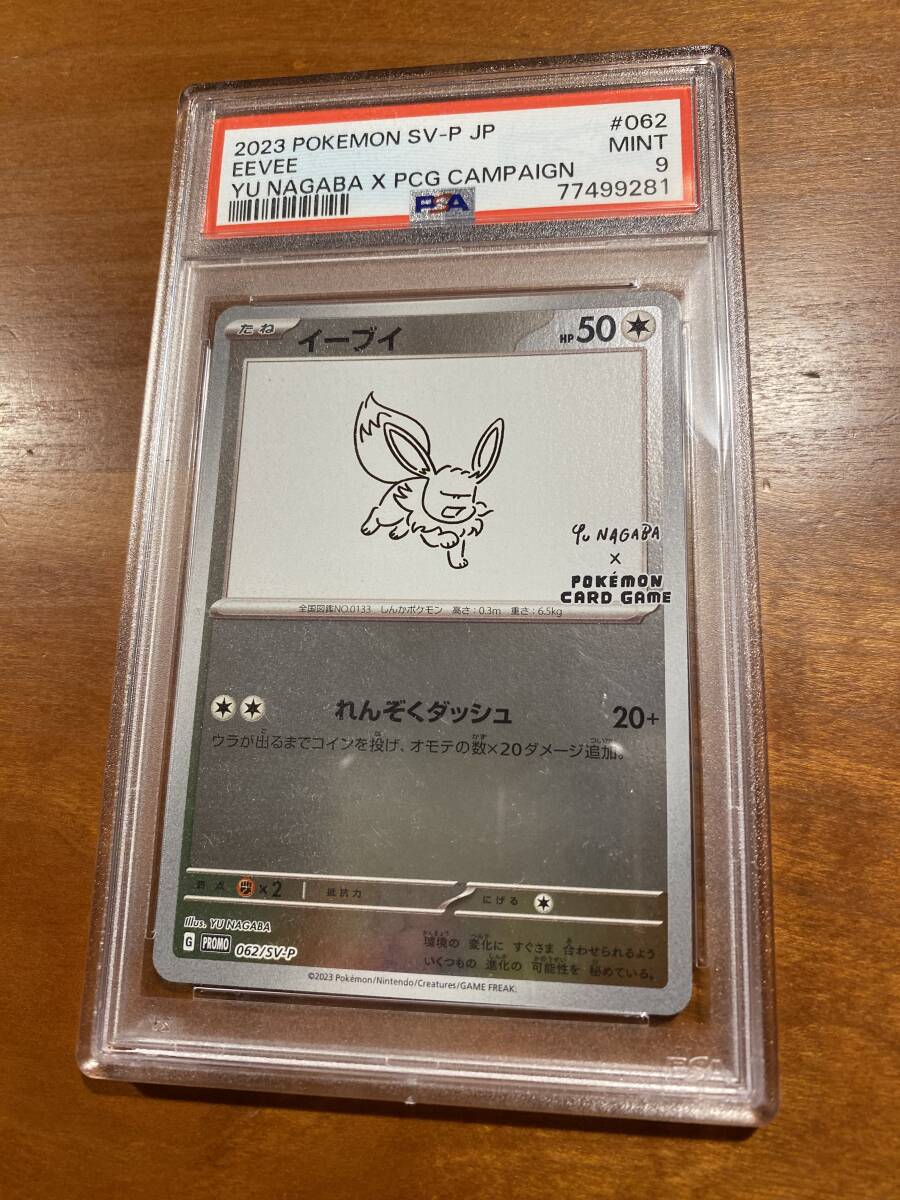

商品名:YUNAGABA×ポケモンカードゲームイーブイズプロモカード9種コンプリート2セットこちらはポケモンセンターオンラインで購入した際についてきたプロモカードを本日開封したものです。

内容:9種類のブイズプロモカード各2枚の計18枚セット

状態:新品未使用(開封後はスリーブに入れ暗所保管しています)

国内正規品

※購入後1時間以内にお支払い可能な方のみご購入下さい。

※偽物とのすり替え防止のため、購入後の返品、キャンセル等はお受けできません。

※新規の方、マナーの悪い方、こちらの判断で取引に不安のある方はご購入をお断りさせて頂く場合があります。

※新品ですが一度個人の手に渡っていますので神経質な方は入札をお控えください。

※期限内に発送いたしますので催促はご遠慮下さい。

その他わからないことがありましたら、お気軽にご質問ください。

シリーズ···プロモーションカード

22800円送料込 長場雄 イーブイ プロモ カード コンプリートセット 2セット ブイズエンタメ/ホビートレーディングカードポケモンカード × 長場雄 YU NAGABA イーブイ プロモ 全9種 コンプ-ポケモン - 送込 長場雄 イーブイズ プロモ カード コンプリートセット

メルカリ便】ポケモンカード イーブイ プロモカードパック 長場雄-

ブイズ プロモパック コンプリート 9種セット yu nagaba 長場雄①-

ポケモンカード × 長場雄 YU NAGABA イーブイ プロモ 全9種 コンプ-

長場雄 イーブイズ プロモ カード コンプリートセット 2セット ブイズ

公式ファッション通販 イーブイプロモ コンプリートセット 長場雄

イーブイ プロモ 長場雄 YU NAGABA 全9種 コンプ-

長場 イーブイ プロモ 9種セット フルコンプ-

YU NAGABA × ポケモンカードゲーム」 イーブイたちをモチーフにした

公式ファッション通販 イーブイプロモ コンプリートセット 長場雄

イーブイ プロモ コンプ nagaba yu ポケカ イーブイズ ブイズ-

販売新品 長場雄 イーブイ ブイズ プロモパック コンプリート

ポケモンカード yu nagaba イーブイ 9種類コンプリート 新品-

2024年最新】長場雄 イーブイの人気アイテム - メルカリ

コンプ ポケモンカードゲーム × yu nagaba プロモ イーブイ ブラッキー

正規品安心保証 イーブイ プロモ 長場雄 YU NAGABA 全9種 コンプ 未

堅実な究極の ポケモンカード引退品 リザードン,フシギバナ,カメックス

ポケモン - 送込 長場雄 イーブイズ プロモ カード コンプリートセット

イーブイ プロモ コンプ nagaba yu ポケカ イーブイズ ブイズ-

2024年最新】長場雄 イーブイの人気アイテム - メルカリ

イーブイプロモ 長場 YU NAGABA コンプリート 9枚セット①-

独特な店 25枚セット‼ メザスタ ブイズ 8種 コンプリート セット ②

公式ファッション通販 イーブイプロモ コンプリートセット 長場雄

2024年最新】長場雄 イーブイの人気アイテム - メルカリ

ポケモンカード × 長場雄 YU NAGABA イーブイ プロモ 全9種 コンプ-

ポケモン - 送込 長場雄 イーブイズ プロモ カード コンプリートセット

イーブイ プロモ コンプ nagaba yu ポケカ イーブイズ ブイズ-

YU NAGABA × ポケモンカードゲーム」 イーブイたちをモチーフにした

コンプ ポケモンカードゲーム × yu nagaba プロモ イーブイ ブラッキー

ポケモン - 送込 長場雄 イーブイズ プロモ カード コンプリートセット

YU NAGABA × ポケモンカードゲーム イーブイズ 9枚 コンプ 長場雄

ブイズ - ポケモンカードゲーム

2024年最新】長場雄 イーブイの人気アイテム - メルカリ

ポケモンカードSV プロモ 9枚 コンプ ② - ポケモンカードゲーム

イーブイ プロモ 9種コンプ yu nagaba ポケカ ポケモンカード-

ポケカ】イーブイズプロモカード一覧と相場(YU NAGABAコラボ

YU NAGABA × ポケモンカードゲーム」 イーブイたちをモチーフにした

堅実な究極の ポケモンカード引退品 リザードン,フシギバナ,カメックス

2024年最新】Yahoo!オークション -ポケモンカード プロモ イーブイの

人気トレンド ブラッキー、ニンフィア 長場 長場 プロモ bn-sports.co.jp

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています